Apply the VAT Fuel Scale Charge/Private Disallowance

Updated May 8th, 2024

Who is this guide for?

Accounts Users and Accounts Supervisors

At each quarter end there may be a VAT Fuel Scale Charge to apply to the Output VAT figures. This guide will take you through applying this

This can be achieved in Osprey by making the following postings. The end result will be that on the VAT return the Net amount will be added to box 6 (Value of Outputs) and the VAT will appear in Box 1 (Output VAT), and the VAT amount will be the expense in the Expense nominal.

Create a new Income nominal

Firstly you will need to create a new income nominal for the Fuel Scale Charge postings. Ensure it is an Income nominal and that it is set for inclusion in the VAT return. (click link below for a guide on how to do this) Managing Nominal Ledgers >

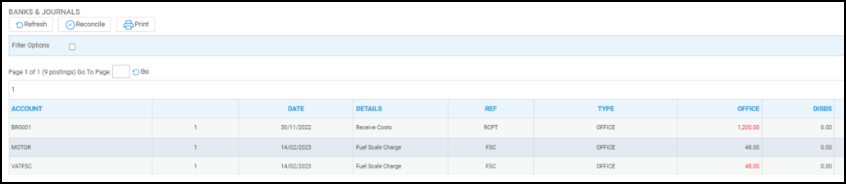

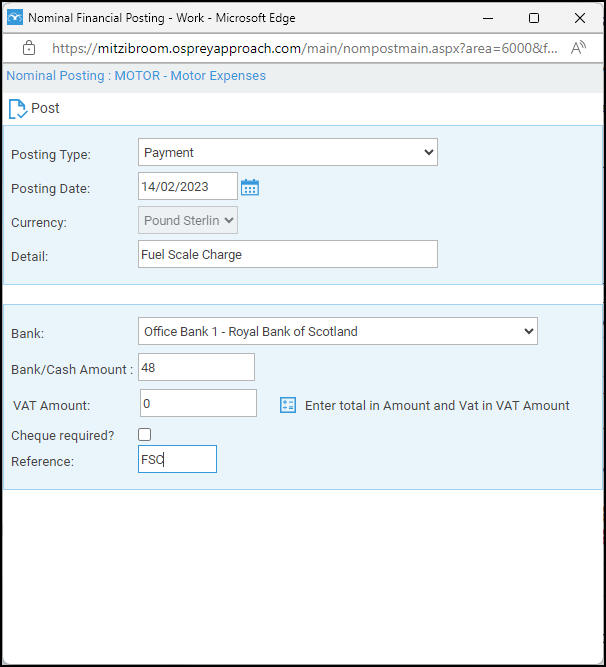

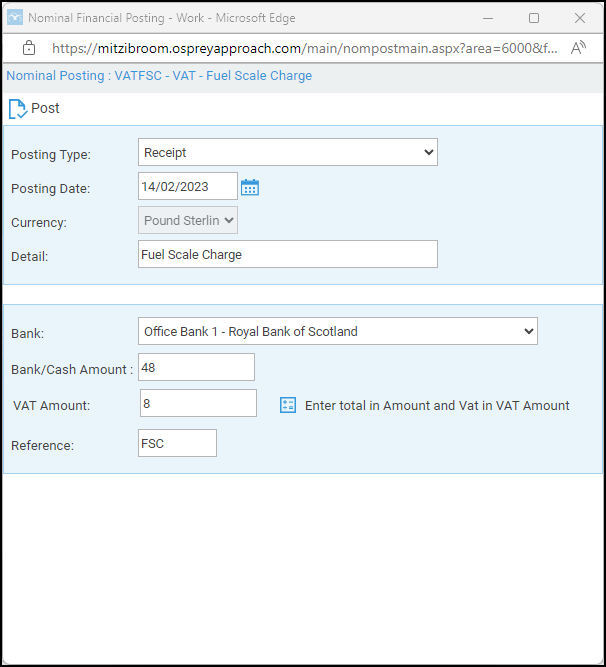

Post the VAT fuel scale charge

- Select your expense nominal (eg Motor Expenses) from the nominal drop down list. Using the Payment posting type, post the Gross amount of the Fuel Scale Charge to this Nominal with no VAT split.

- Select the Fuel Scale Charge Nominal and make a posting using posting type Receipt, for the fuel scale charge, split for VAT.

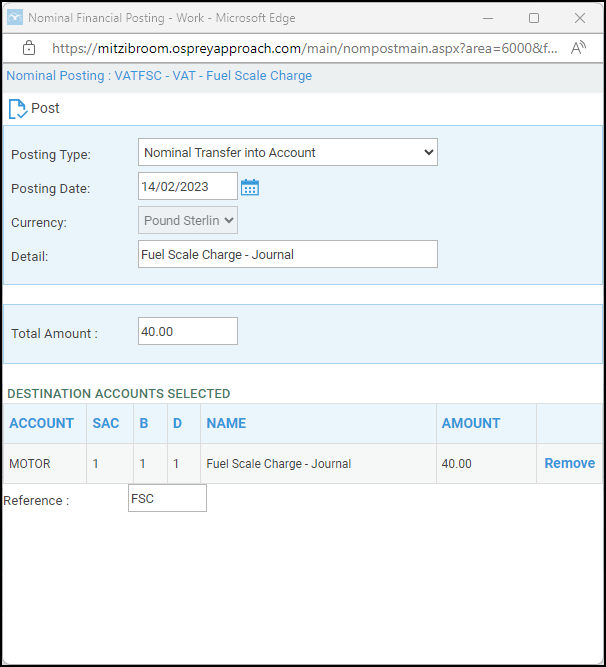

Journal the balance to expenses

Staying on the Fuel Scale Charge Nominal as above, select the posting type Nominal Transfer Into Account. Click Post. Complete the details of the posting using the net Fuel Scale Charge amount in the Total amount box. In the Select Destination area, enter the nominal code for the expense nominal and then select accept from the center of the screen.

Bank Reconciliation

On your bank reconciliation there should now show two entries, a debit and a credit, that can both be ticked.